Economy

Jay Brown for Congress: On the Economy

I’ve worked hard as a doctor and have done well. My federal tax rate of about 37% is a good amount of money. If my tax dollars are spent wisely, I’ve no qualms about paying more if that gets us better schools, better roads, a cleaner environment and a safer world.

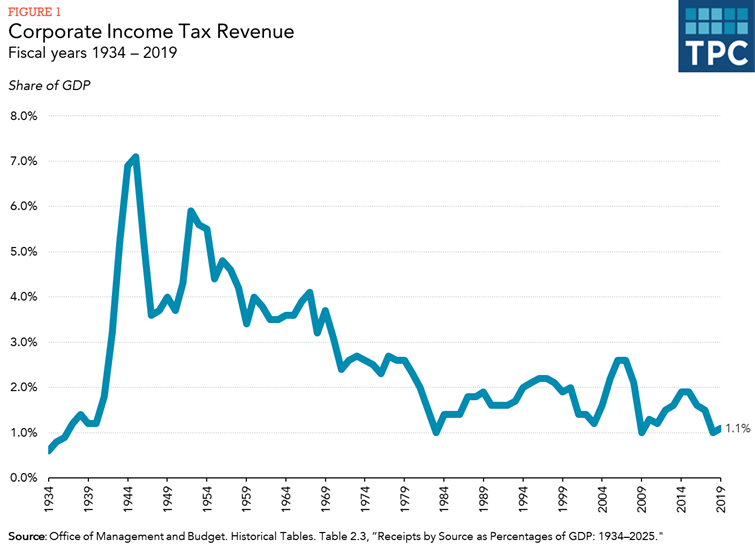

However, for folks at the top of the economic pyramid, even higher rates make sense. During President Eisenhower’s administration, we had the very richest paying over 90% tax rates and corporations paying tax rates of more than 50%. Today we have corporations and the outrageously wealthy paying less and less. That places a greater burden on the rest of us.

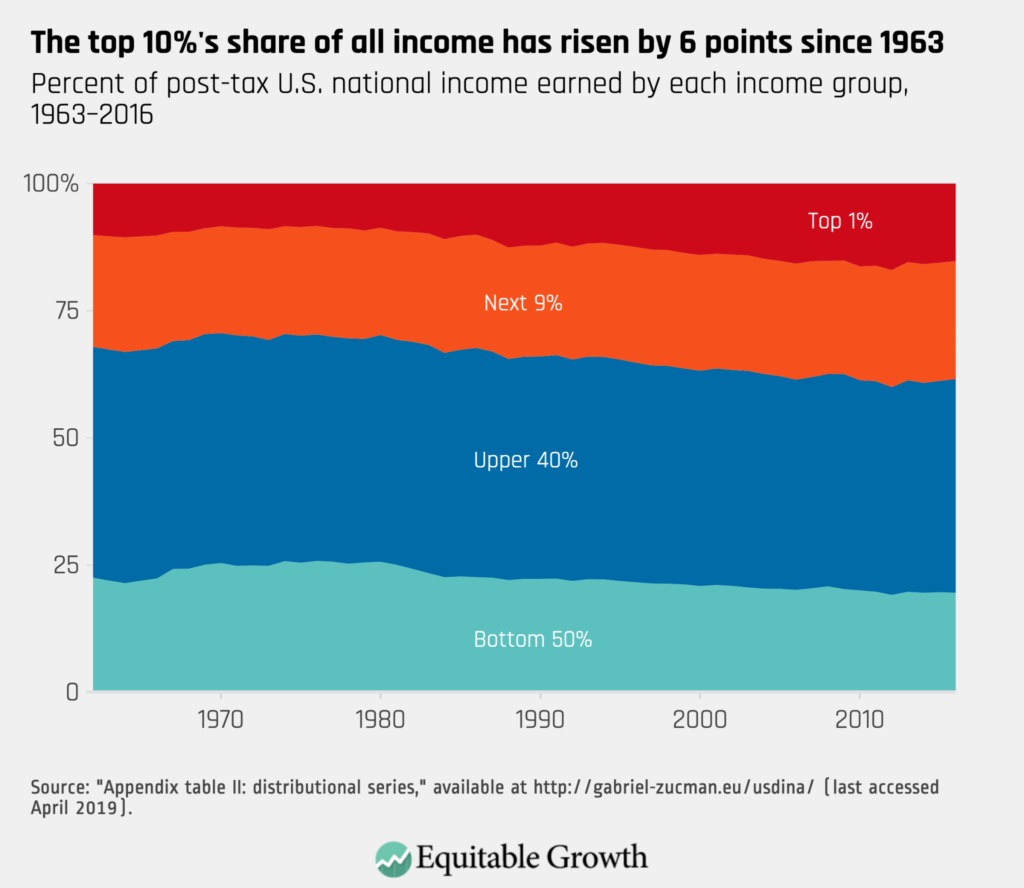

Currently, wealth is concentrated in the hands of too few. This can be fixed by changing the tax structure of extreme wealth.

Yes, I am a capitalist.

I’ve started a few businesses and served as an officer of a corporation that was doing about $400,000,000 a year of business. Capitalism generates wealth and is the best economic engine. But as Adam Smith knew, capitalism must be protected from greedy cheaters. The safety of workers, the protection of the environment and telling the truth to the consumer should be the purview of the state. Regulation has been vilified as intrinsically harmful by demagogues and those who wanted to take advantage of the rest of us. While as with most things, regulation can be abused, our solutions should come from the middle where common sense lives.

Taxes are the price of civilization. (Oliver Wendell Holmes)

I would argue that the goal of the current Republican party is to facilitate the advantages of the privileged. Abortion, guns, which bathrooms kids use and what books they can read are purposeful distractions toward working people to support a Republican party that is focused, ultimately, on the interests of the very wealthy. While we must have fairness embedded in our system, this part is easy. Everyone should pay the same amount of taxes on their first $10,000, their next $10,000 and so on. But those who would have to pay 50% tax on their second million would still be fine. More than fine.

I make money basically two ways. I earn it by seeing patients, but my savings are also making money. While my earned income is taxed at 37%, my capital gains are taxed at only 15%. The rich do get richer. And I believe that is wrong.

My mission in Congress will be to help right that wrong.

– Dr. Jay Brown